tax shield formula dcf

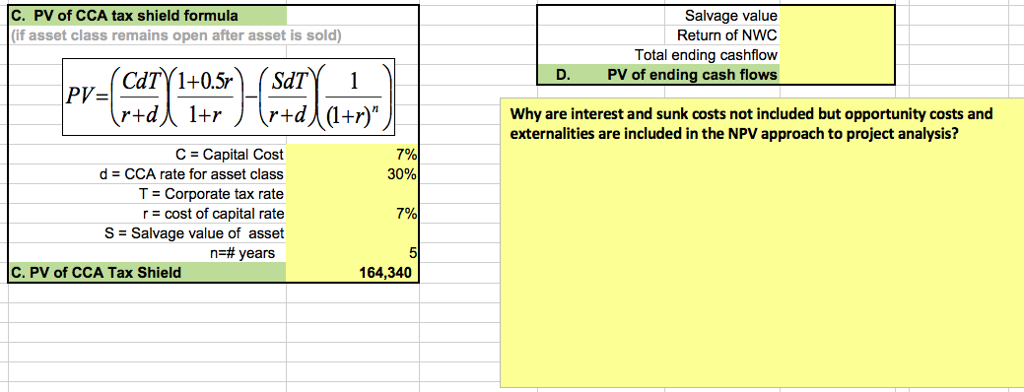

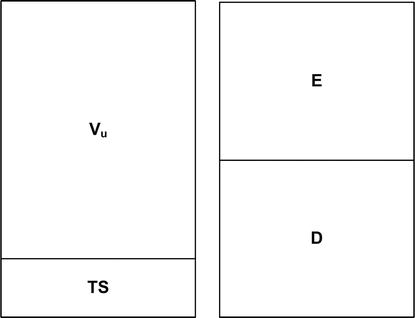

The formula for calculating the depreciation tax shield is as follows. Concerning DCF there are three widely used methods to calculate the present value of a company.

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

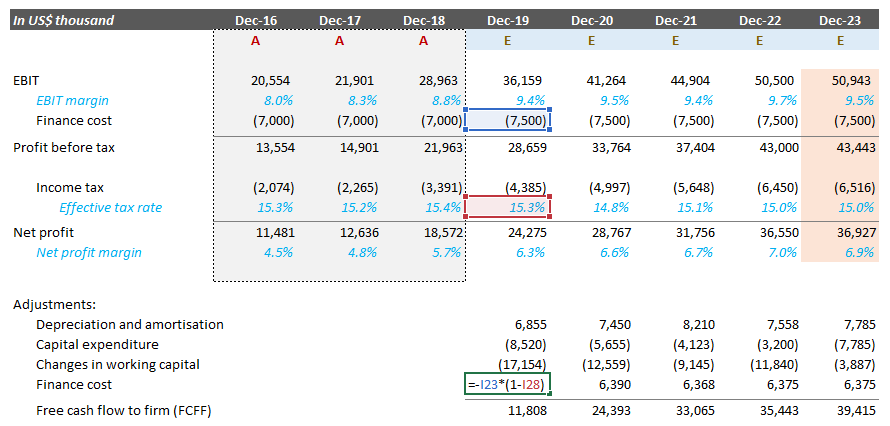

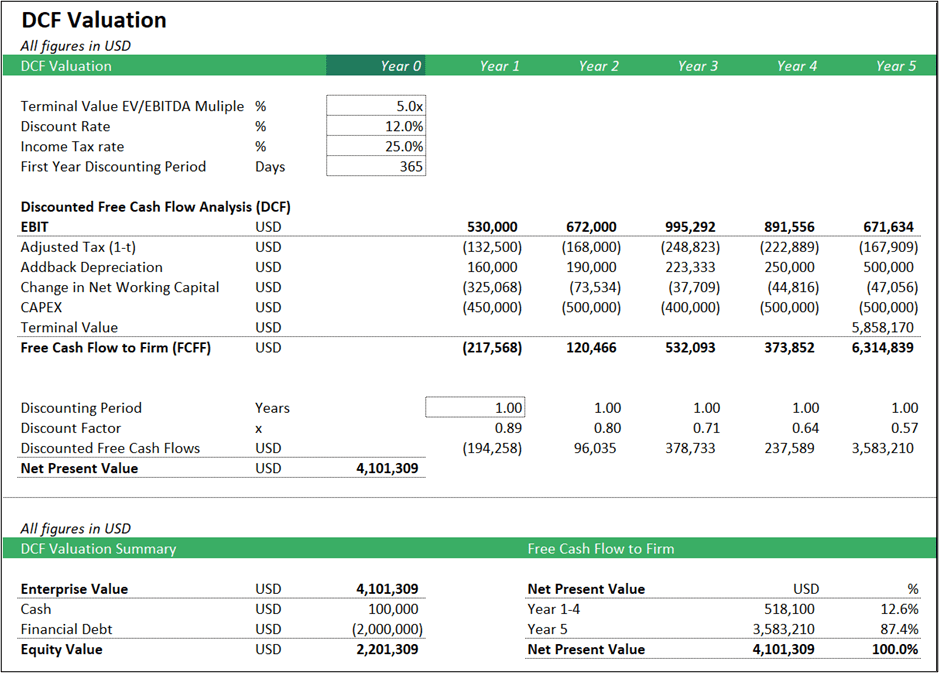

FCFFa EBIT 1-tax rate Non-Cash Charges Depreciation - Working Capital investments - Fixed capital investments This formula is quite popular in practise.

. The flows to equity method. Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually.

The intent of a tax shield is to defer or eliminate a tax liability. To calculate the Tax shield you multiply the Deductible Expense by the Income Tax Rate. FCF EBIT 1-T DA - CAPEX - Change in working capital - Principal repayment - After tax interests New loans - Taxes.

Instead add the interest of. This is usually the deduction multiplied by the tax rate. Tax Shield Deduction x Tax Rate.

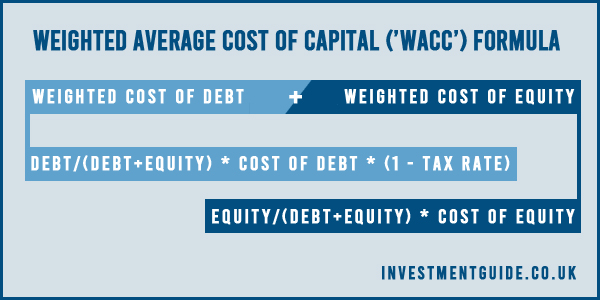

The DCF valuation of the business is simply equal to the sum of the discounted projected Free Cash Flow amounts plus the discounted Terminal Value amount. The standard WACC approach. There is no exact answer for.

The formula includes that comes. Further I can show a general expression for tax shields implementation wherein this well known WACC formula is only a special case. The Depreciation Tax Shield reflects the Income Tax savings created by Depreciation Expense.

And then discount it to the cost of equity right. This can lower the effective tax rate of a business or individual which is especially important when their reported. For some calculations such as free cash flow putting back a tax shield can not be as straightforward as just adding the entire tax shields worth.

The formula for calculating the interest tax shield is as follows. The effect of a tax shield can be determined using a formula. Tax rate debt load interest rate interest rate.

The present value of the interest tax shield is therefore calculated as.

Using Apv A Better Tool For Valuing Operations

Discounted Cash Flow Dcf Valuation Investment Guide

Depreciation Tax Shield Formula And Calculation

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Using Apv A Better Tool For Valuing Operations

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Discounted Cash Flow Analysis Street Of Walls

Tough Outdoor Supplies Is Looking To Expand Its Chegg Com

What Is The Depreciation Tax Shield The Ultimate Guide 2021

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Discounted Cash Flow Modeling Valuation

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Dcf Model Method Discount Cash Flow Valuation Example

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen